When it comes to obtaining a loan, your credit score plays a pivotal role. It’s a numerical representation of your creditworthiness and serves as a decisive factor for lenders when determining your eligibility and the interest rates you’ll be offered. To achieve better loan rates, it’s imperative to comprehend how your credit score functions and what steps you can take to improve it.

Chapter 1: What Is a Credit Score?

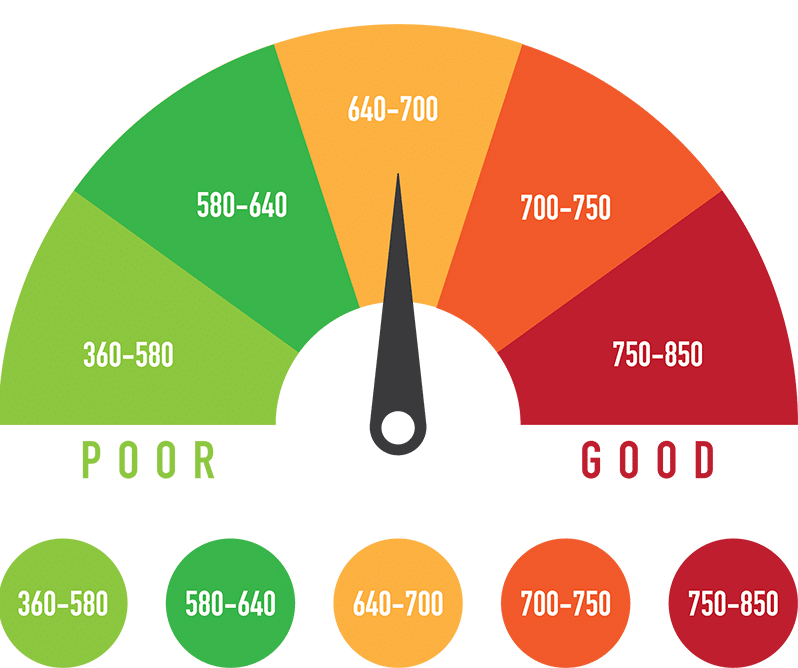

A credit score is a three-digit number that reflects your credit history. Typically ranging from 300 to 850, it’s generated based on various factors such as your payment history, credit utilization, length of credit history, types of credit accounts, and recent inquiries. This score serves as a quick reference for lenders to assess the risk associated with lending you money.

Chapter 2: Importance of a Good Credit Score

A high credit score indicates to lenders that you’re a responsible borrower, capable of managing credit and making timely payments. Consequently, a good credit score leads to favorable loan terms, including lower interest rates, higher loan amounts, and more attractive repayment options.

Chapter 3: Tips to Improve Your Credit Score

1. Monitor Your Credit Report Regularly

Start by obtaining your credit report from the major credit bureaus – Equifax, Experian, and TransUnion. Review it meticulously for any errors or inaccuracies. Dispute and rectify any discrepancies promptly, as incorrect information can negatively impact your score.

2. Make Timely Payments

Your payment history contributes significantly to your credit score. Ensure you pay your bills on time, including credit card bills, loans, and utility payments. Late payments can severely dent your score, so setting up automatic payments or reminders can be beneficial.

3. Keep Credit Utilization Low

Maintain a healthy credit utilization ratio by using only a small portion of your available credit. Aim to keep your credit card balances well below the maximum limit. Lower credit utilization demonstrates responsible borrowing behavior and positively impacts your score.

4. Diversify Your Credit Accounts

Having a mix of credit types, such as credit cards, installment loans, and mortgages, can positively influence your credit score. However, only acquire credit that you genuinely need and can manage responsibly.

5. Avoid Opening Multiple Accounts Rapidly

Applying for several credit accounts in a short period can raise red flags for lenders, indicating financial instability or desperation for credit. Such actions may lower your score temporarily.

6. Increase Credit Limits

Requesting a credit limit increase can potentially improve your credit utilization ratio, provided you don’t increase your spending. However, exercise caution to avoid overspending, which could lead to increased debt.

7. Maintain Long-Term Credit Accounts

The age of your credit accounts matters. Keeping older accounts open showcases a longer credit history, positively influencing your score.

Conclusion

Improving your credit score is a gradual process that demands diligence and responsible financial behavior. By following these tips and consistently managing your finances, you can significantly enhance your credit score, paving the way for better loan rates and improved financial opportunities.