In today’s fast-paced and dynamic economic landscape, the significance of effective financial planning cannot be overstated. At the core of this process lies budgeting, a fundamental tool that serves as the cornerstone for individuals, businesses, and organizations to achieve their financial goals and secure a stable future. Understanding the vital role of budgeting within the realm of financial planning is crucial for anyone seeking to make informed and strategic decisions about their financial well-being. Through disciplined and meticulous budgeting practices, individuals and entities can not only manage their funds efficiently but also pave the way for long-term prosperity and financial security.

Understanding the Essence of Budgeting in Financial Planning

Budgeting, in essence, encompasses the meticulous process of creating a comprehensive plan that outlines an individual’s or an organization’s financial goals and objectives. It involves an in-depth analysis of income, expenditures, and financial resources, enabling a clear understanding of where funds are allocated and how they can be effectively managed. This structured approach facilitates the identification of financial strengths, weaknesses, and opportunities, thereby enabling individuals and businesses to make informed decisions that align with their long-term financial aspirations.

Cultivating Financial Discipline through Budgeting

One of the most significant advantages of integrating budgeting into the fabric of financial planning is the cultivation of financial discipline. By adhering to a well-structured budget, individuals and businesses can instill a sense of financial responsibility and accountability, which in turn fosters a culture of prudent spending and savings. Through the cultivation of financial discipline, one can proactively mitigate financial risks, minimize unnecessary expenditures, and ensure a steady flow of savings, thus fortifying their financial stability and resilience.

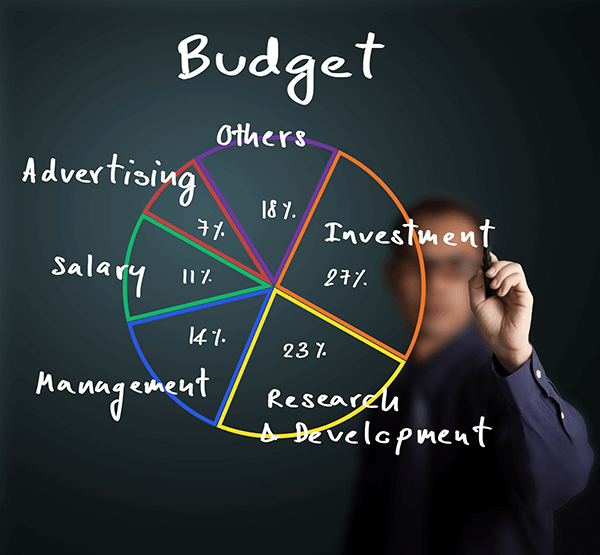

Leveraging Budgeting for Efficient Resource Allocation

Effective budgeting serves as a powerful tool for resource allocation, allowing individuals and businesses to allocate their financial resources in a strategic manner that aligns with their long-term objectives. By understanding the patterns of income and expenditures, entities can make informed decisions about the allocation of resources, directing funds towards areas that require further investment while simultaneously identifying areas that warrant cost-cutting measures. This proactive approach not only optimizes resource utilization but also enhances the overall efficiency and productivity of the financial planning process.

Securing Long-Term Financial Stability and Growth

By integrating budgeting into their financial planning endeavors, individuals and businesses can pave the way for long-term financial stability and growth. A well-structured budget serves as a roadmap that guides financial decisions, ensuring that every financial step taken is aligned with overarching objectives and long-term aspirations. Through the cultivation of financial stability, individuals can safeguard themselves against unforeseen financial hardships, while businesses can position themselves for sustainable growth, innovation, and competitiveness within their respective industries.

The Role of Technology in Enhancing Budgeting Practices

In today’s digital era, the integration of technology has revolutionized the landscape of budgeting, offering advanced tools and software that streamline the budgeting process and enhance its overall efficacy. From user-friendly budgeting apps to sophisticated financial management software, the contemporary market offers a plethora of technological solutions that empower individuals and businesses to manage their finances with unparalleled precision and efficiency. By leveraging these technological advancements, entities can not only simplify the budgeting process but also gain valuable insights into their financial performance, enabling them to make data-driven decisions that maximize their financial potential.

Embracing a Proactive Approach to Financial Well-being

In conclusion, the significance of budgeting in financial planning cannot be overstated. Through the cultivation of financial discipline, efficient resource allocation, and the integration of technology, individuals and businesses can proactively pave the way for long-term financial stability, growth, and prosperity. By embracing a holistic approach to financial well-being, one can navigate the complexities of the modern financial landscape with confidence and resilience, ensuring a secure and prosperous future for themselves and their organizations.